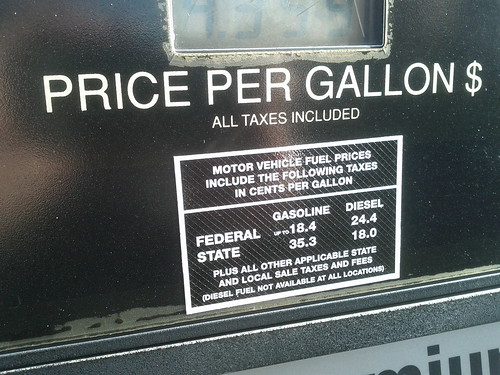

I saw this today at the gas station: The US mineral oil tax rates. For your entertainment, let's compare those with the equivalent back in Germany (Note that I am intentionally not considering sales tax).

State and federal taxes added together, one pays 53.7 US cents per gallon in fuel taxes per gallon of gasoline. At a price of 4.35 per gallon (for premium fuel, in this case), that's about 12 percent.

In Germany, the fuel tax is 65.45 EUR cents per liter, or 3.50 US dollars per gallon. Premium fuel is currently about 1.65 EUR/l (or 8.83 USD/gal), so the fuel tax amounts to about 39.6 percent, or more than three times the percentage in the US.

You are welcome to draw numerous conclusions from this (and are encouraged to leave those in the comments), I will only add one for now: As you can see, the tax rates differ significantly, but even if you remove the fuel (and, not shown here, the sales tax) from this mix, the prices still don't even out -- indicating that fuel is not only taxed differently on either side of the pond, but is also behaves significantly different as a product. Sounds like an interesting economic research topic to me.